STEFANO LEONARDI / Профиль

- Информация

- 5+ летопыт работы0продуктов0демо-версий0работ0сигналов0подписчиков

Investor, technical and fundamental Analyst - Developer of Algorithmic systems

I'm passionate about economics, monetary policy, geopolitics, commodities, blockchain, international political relations, topic and news related to affairs and international political news.

* Use my trustworthy ECN broker with tight spreads, low fees and perfect support.

[Use it to better copy my signal's trades]

Register at: https://my.teletrade-dj.com/agent_pp.html?agent_pp=24583607

I'm passionate about economics, monetary policy, geopolitics, commodities, blockchain, international political relations, topic and news related to affairs and international political news.

* Use my trustworthy ECN broker with tight spreads, low fees and perfect support.

[Use it to better copy my signal's trades]

Register at: https://my.teletrade-dj.com/agent_pp.html?agent_pp=24583607

STEFANO LEONARDI

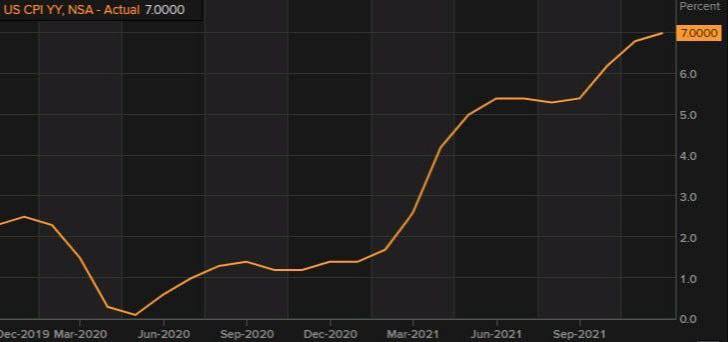

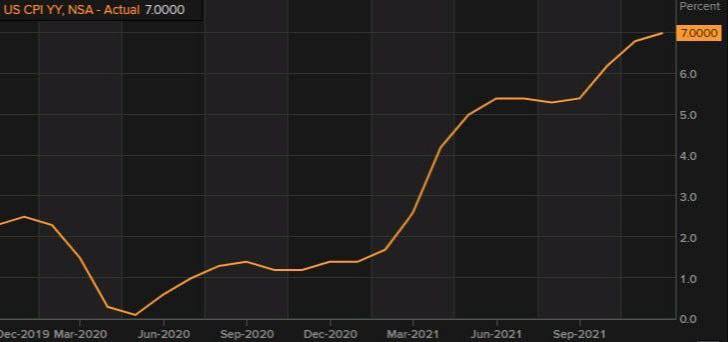

But it's not just the US dollar that will be challenged. They are all global fiat currencies of highly indebted countries.

We are in a global debt trap. Monetary devaluation is inevitable.

For bargain-seeking investors, precious metals are one of the assets to be in today.

All this will most likely create an incredible setup for gold and silver.

The train cannot be missed.

-

Telegram:

@stefanoleonardi

Instagram:

@leonardistefanofx

We are in a global debt trap. Monetary devaluation is inevitable.

For bargain-seeking investors, precious metals are one of the assets to be in today.

All this will most likely create an incredible setup for gold and silver.

The train cannot be missed.

-

Telegram:

@stefanoleonardi

Instagram:

@leonardistefanofx

STEFANO LEONARDI

Hello Copiers and Members,

2022 will test many of my goals to achieve.

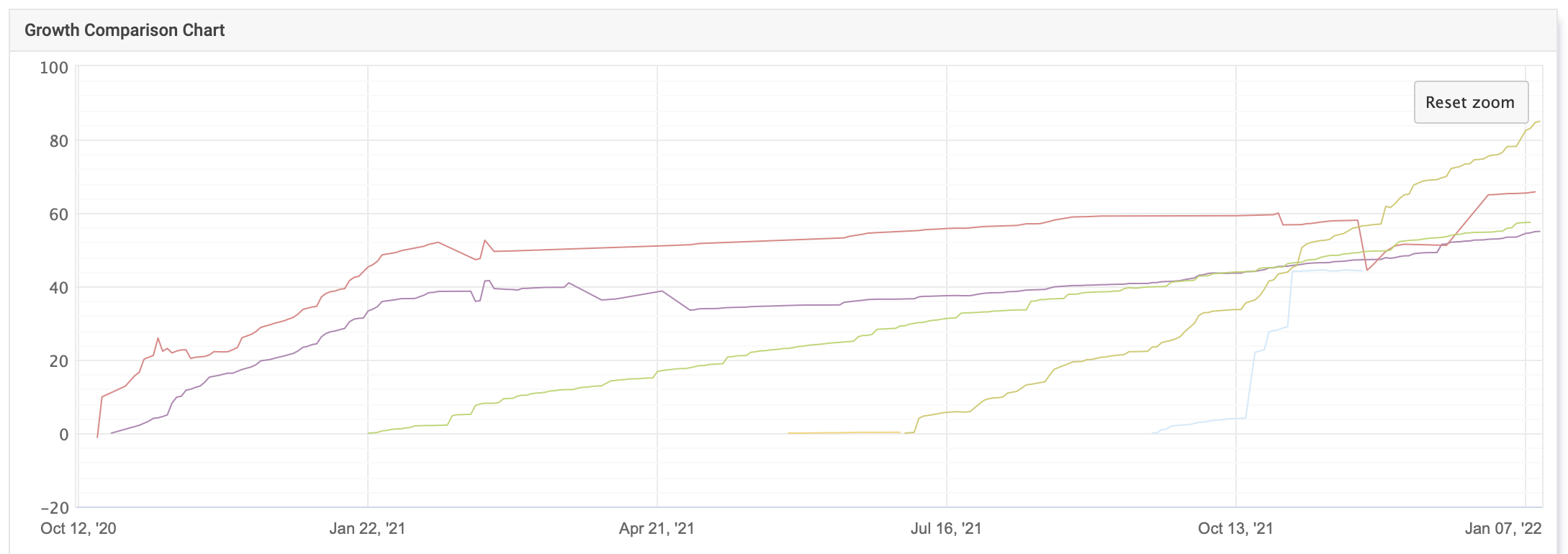

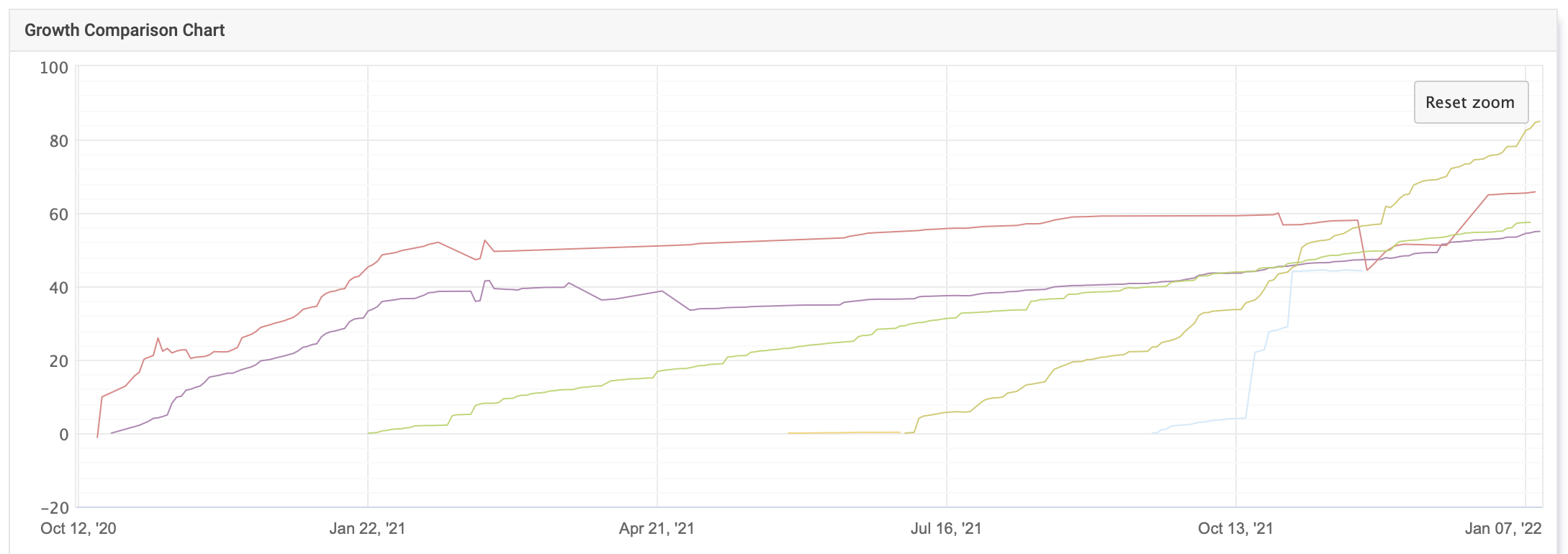

The backtest of the other my 4 strategies is giving interesting results, almost ready to carve out an important space in my portfolio.

Please be careful on markets:

Soon there will be a big bug, a giant rollover that will totally overturn the game table, but I'll be ready to take advantage of it.

Even after the largest liquidity injection ever in history, equity markets are not only overvalued relative to their fundamentals, but also relative to the money supply.

The ratio of the S&P 500 to the money supply (M2) has recently formed a double top from the crazy levels of the tech bubble.

2022 will test many of my goals to achieve.

The backtest of the other my 4 strategies is giving interesting results, almost ready to carve out an important space in my portfolio.

Please be careful on markets:

Soon there will be a big bug, a giant rollover that will totally overturn the game table, but I'll be ready to take advantage of it.

Even after the largest liquidity injection ever in history, equity markets are not only overvalued relative to their fundamentals, but also relative to the money supply.

The ratio of the S&P 500 to the money supply (M2) has recently formed a double top from the crazy levels of the tech bubble.